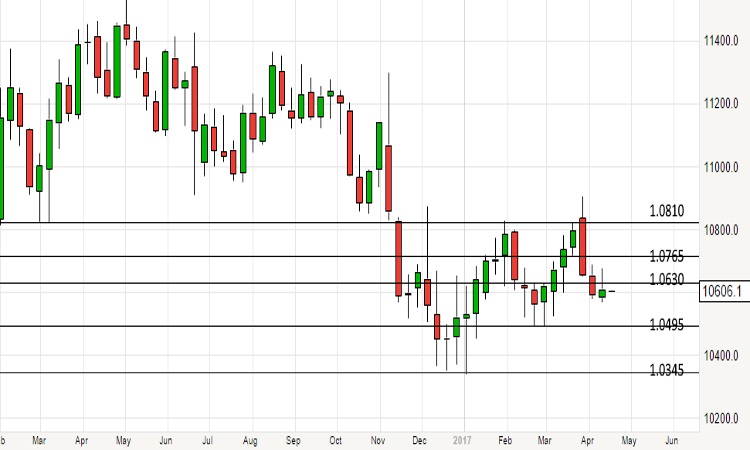

EUR/USD spot: 1.0606

Support: 1.0570, 1.0495, 1.0345

Resistance: 1.0630, 1.0765, 1.081

Strategy:

The EUR/USD were driven by conflicting data and messages out of the US last week. The Euro found support just above 1.057, and the rebound was propelled higher when Donald Trump said the USD was getting too strong. On Thursday, the Euro gave up some ground when a stronger than expected University of Michigan confidence index was released. Last week we suggested looking for a strong bullish reversal before buying the Euro, and that’s exactly what we got. Based on price action the trade is still valid, though sentiment and fundamentals may work against it.

Emmanuel Macron’s lead in the polls has fallen which is creating nervousness in European markets. If Macron doesn’t make it through the first round of voting we can expect the Euro to come under pressure. There is very little important data scheduled for release this week which will leave the market to focus on the election and geo-political concerns around North Korea and US-Russia relations.

Of course, there is also the chance of a surprise out of the US, but political news flow has slowed in the past few weeks.

The weekly chart has changed very little from last week. The longer-term bias toward longs remain valid while the pair remain above 1.0495, as this leaves the higher high and higher low intact. If risk aversion grows it’s likely that the 1.0495 level will give way and the longer-term picture will become bearish for the Euro.

EUR/USD Weekly chart

The short-term price action is not decisive and reflects uncertainty. It’s probably best to avoid short term trades in this environment, but for aggressive traders there are reasons to consider a bearish stance:

The 4-hour chart is testing a diagonal support level at 1.0605, and a break of that level may trigger stops lower down. Sentiment is now in favour of the Euro, which may add fuel to a USD rally if these levels break. In the case of a move lower, the first target would be 1.057, and the second 1.0495.

EUR/USD 4-Hour Chart

Get the latest fundamental analyses, technical analyses and the most up to date Forex news catered to your interests.