EUR/USD Spot Price: 1.1742

Support: 1.1700, 1.1662, 1.1628

Resistance: 1.1781, 1.1800, 1.1850

Trade Ideas - Looking for the EUR/USD to continue its Bullish Trend

The Euro kept holding strong at 1.1700, however in the short term there just wasn’t enough buyers to help it push to the upside.

This week we want to see it spike through 1.1800 and higher. Enter on a pullback at 1.1700 as that’s the key support level that keeps on holding.

The fact that there is so much focus on Jackson Hole, we need to be very careful of the technicals this week. Any fundamental shift in monetary policy or even a slight suggestion will throw technicals out the door, so trade accordingly.

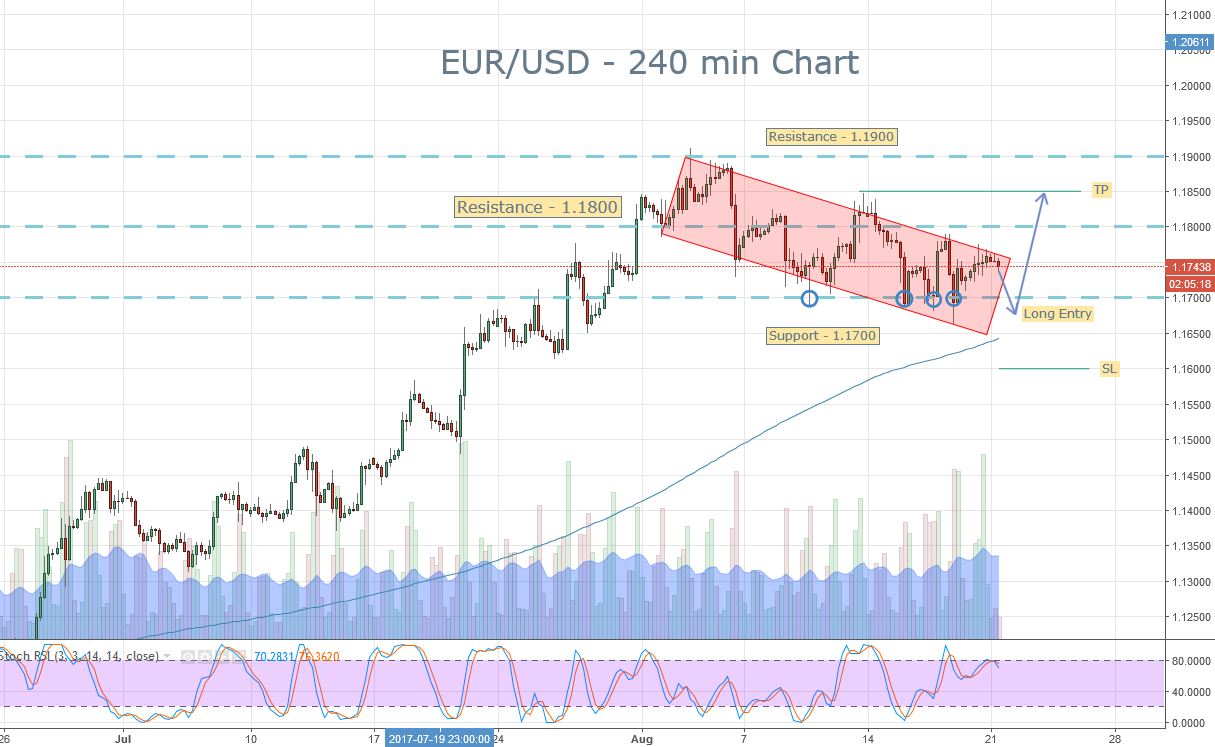

EUR/USD 240 min Chart - EUR/USD is looking to hit 1.1800-1.1850

A string of economic data hit the EUR/USD hard last week including FOMC updates and minutes from the ECB. We didn’t get the upside momentum that we had been hoping for however there was still considerable strength in the Euro as the all important 1.1700 level continued to hold despite numerous attempts on it to break.

All the focus this week turns to Jackson Hole in Wyoming, where central bankers, key policy makers and academics will be meeting to discuss the upcoming trends in the economy and how best to proceed with monetary policy worldwide.

In the past Jackson Hole has been an incredibly important event and has given us much insight into the direction of monetary policy.

In 2010 Chairman of the Federal Reserve Ben Bernanke, told all that would listen, how the US was about to unleash QE on the markets. At the time few would predict the impact that would have on US equity markets.

In 2014 MArio Draghi came out and told a similar story that the ECB was ready to launch stimulus of their own. This too proved to be a powerful market event that has shaped trade for years to come.

While we might not get the same level of impact this week, traders will be paying close attention to exactly what is in store. Unnamed sources have suggested that Draghi won’t be releasing any new developments regarding ECB policy, however take that with a grain of salt.

While JAckson Hole is the key risk event this week, there is a range of different data releases from Germany that will likely have an impact on the EUR/USD including PPI, PMI and ZEW Economic Sentiment.

The EUR/USD is still very much on a bullish uptrend. At the moment the key level is clearly 1.1700. We tested it a number of times last week and it continued to hold up. If we break through and hold then that might give us an inclination that the trend is somewhat overextended, but until that happens we need to remain strongly bullish longer term.

EUR/USD - 240 min Chart - Key short term support and resistance

Get the latest fundamental analyses, technical analyses and the most up to date Forex news catered to your interests.